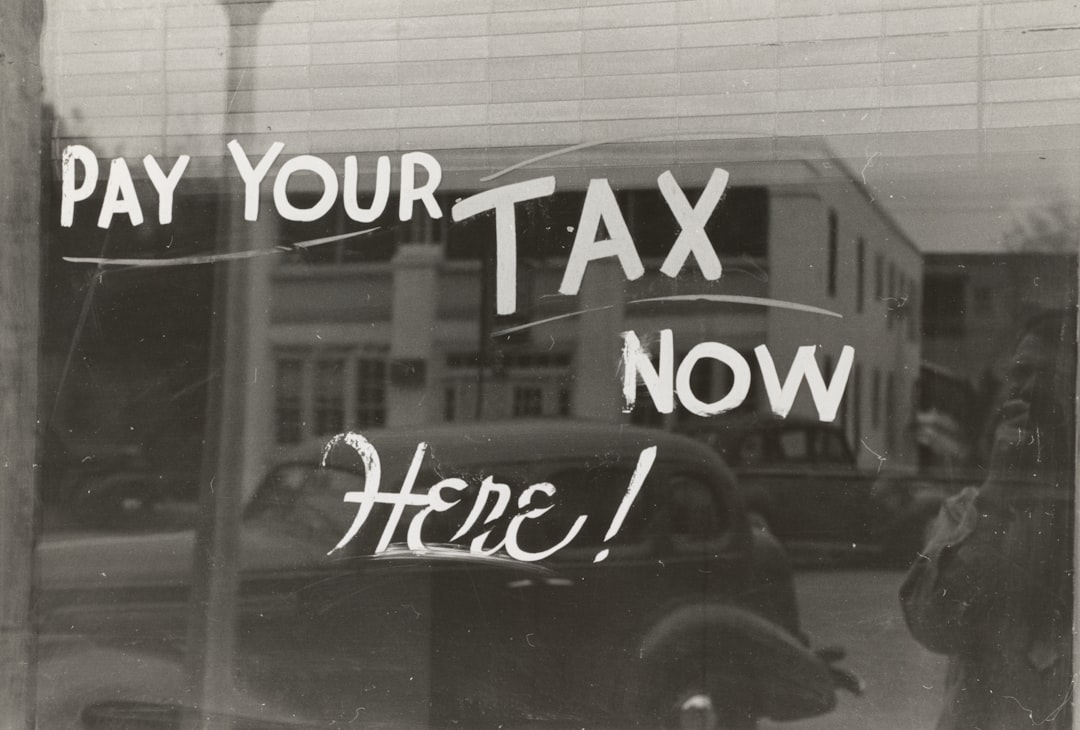

As we head into 2025, it’s important for taxpayers to be aware of the latest tax code changes that will affect their tax filing. Understanding these changes can help individuals and businesses prepare and plan accordingly to ensure compliance with the law. One important aspect to consider is the new tax code changes that have been implemented for the year 2025. These changes can have a significant impact on how taxpayers file their taxes and the amount they owe to the government.

One of the key changes to the tax code for 2025 is the introduction of the V Tax Filling system. This new system aims to streamline the tax filing process and make it more efficient for taxpayers. The V Tax Filling system is designed to simplify the tax filing process by allowing taxpayers to file their taxes electronically and receive their refunds faster. This system also includes various deductions and credits that could help taxpayers save money on their taxes.

One of the main benefits of the V Tax Filling system is that it reduces the risk of errors in tax filing. By filing taxes electronically, taxpayers can avoid mistakes that could lead to penalties or audits by the IRS. The V Tax Filling system also offers a faster and more secure way to file taxes, as it eliminates the need for paper forms and allows for direct deposit of refunds.

Additionally, the V Tax Filling system includes various deductions and credits that taxpayers can take advantage of to reduce their tax liability. Some of these deductions and credits include the Child Tax Credit, the Earned Income Tax Credit, and the Lifetime Learning Credit. These credits can help individuals and families save money on their taxes and increase their refunds.

Another important aspect of the latest tax code changes for 2025 is the increase in standard deductions. The standard deduction is the amount that taxpayers can subtract from their taxable income to reduce the amount of tax they owe. For 2025, the standard deduction has been increased to help offset the impact of inflation and rising costs of living.

Overall, understanding the latest tax code changes for 2025, including the introduction of the V Tax Filling system, can help taxpayers navigate the tax filing process more effectively. By staying informed and taking advantage of available deductions and credits, individuals and businesses can maximize their tax savings and ensure compliance with the law. It is important to consult with a tax professional or use tax software to ensure accurate and timely filing in order to avoid any penalties or fees.

Find out more at

V Tax Professionals Ltd.

https://www.vtaxservices.com/

9703068221

26 W Dry Creek Cir, Suite 616, Littleton, Colorado, 80120

V Tax Services offers IRS Relief/Resolution, Tax Advisory and Tax Preparation Services. Do you have Tax Troubles? We have solutions, such as affordable, comprehensive tax resolution, that meet your needs.